AtlasTrend May 2023 Portfolio Scoop

The standout positive performers were the Japan’s Nikkei 225 Index, up +7.04% and the U.S. NASDAQ Index, which was up +5.80% (local prices).

Written by Kevin Hua Co-founder & Chief Investment Officer

This information does not take into account your personal objectives, financial situation or needs. You should consider if the relevant investment is appropriate having regard to your own objectives, financial situation and needs.

May Highlights

Developed markets were generally weaker as investors remained concerned about stagnant Chinese growth and recessionary fears globally.

The standout positive performers were the Japan’s Nikkei 225 Index, up +7.04% and the U.S. NASDAQ Index, which was up +5.80% (local prices).

Weakness once again came from Hong Kong’s HSCEI and HSI Index, down -8.04% and -8.35% respectively (local prices) although European markets as well as the U.S. Dow Jones Index were also quite weak.

Weakness of the AUD by +1.73% against the USD and +0.68% against the € helped AUD returns for the Trends and indices.

The monthly performances across our Trends were +7.33%, -1.67% and +1.14% for the Big Data, Online Shopping and Clean Disruption Trends respectively (versus MSCI World ex Australia Index of +1.18%).

In the last 12 months, we have delivered performances of +12.75%, +1.79% and +9.98% for the Big Data, Online Shopping Spree, and Clean Disruption Trends respectively (versus MSCI World ex Australia Index of +13.37%).

In the last 6 months, we have delivered performances of +15.60%, +4.34% and +5.98% for the Big Data, Online Shopping Spree, and Clean Disruption Trends respectively (versus MSCI World ex Australia Index of +7.72%).

In the last 3 months, we have delivered performances of +13.72%, +3.88% and +6.74% for the Big Data, Online Shopping Spree, and Clean Disruption Trends respectively (versus MSCI World ex Australia Index of +8.43%).

Big Data Big Fund

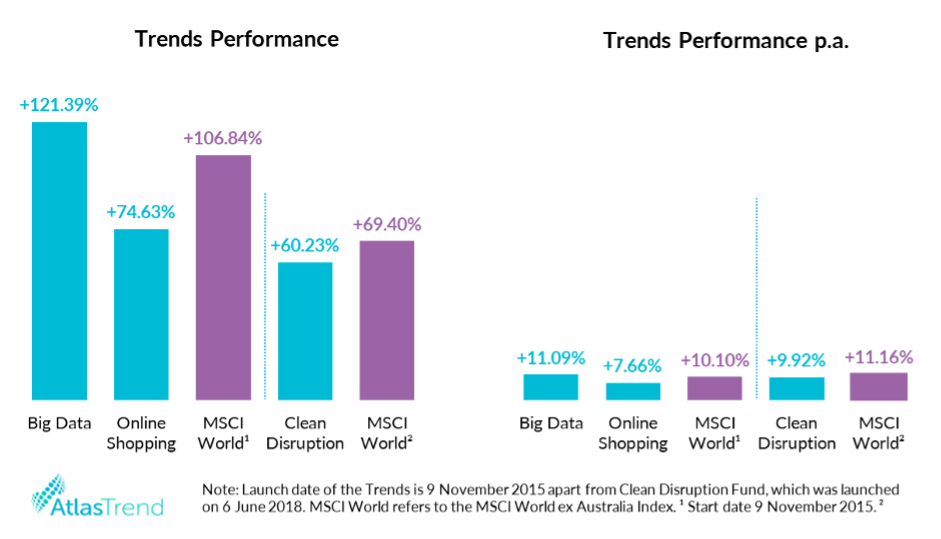

The Trend return for the month was +7.33% and since launch (9 November 2015) is +121.39%.

This Trend has delivered a +11.09% return per annum since inception.

This Trend performed strongly as technology stocks showed solid earnings. It was led by double-digit gains from Splunk, Alphabet, Apple, Amazon.com, Salesfore.com, Spotify and Palo Alto Networks.

Weakness came from the Chinese holdings as well as small holdings in NCSoft and Kyndryl.

As of the end of May 2023, this Trend consisted of 19 companies.

Online Shopping Spree Fund

The Trend return for the month was -1.67% and since launch (9 November 2015) is +74.63%.

This Trend has delivered a +7.66% return per annum.

This Trend had a weak performance as it was held by but its Chinese positions such as Alibaba, Netease, JD.com and Tencent as well as German online retailer, Zalando and Target and Disney.

Positive performers were led by Amazon.com, TheRealReal, Apple and Expedia.com.

As of the end of May 2023, this Trend consisted of 17 companies.

Clean Disruption Fund

The Trend return for the month was +1.14% and since launch (6 June 2018) is +60.23%.

This Trend has delivered a +9.92% return per annum since inception.

This Trend also had a mixed performance, led by KLA-Tencor, First Solar, Vestas Wind Systems, Tomra Systems and Fanuc.

Weakness came from a small position in Varta as well as Northland Power, IPG Photonics and Siemens Healthineers.

As of the end of May 2023, this Trend consisted of 18 companies.

Important notice

Any managed investment fund product (Fund) mentioned in this communication is offered via a Product Disclosure Statement (PDS) which contains all the details of the offer. The PDS is issued by Fundhost as responsible entity for the Funds. Before making any decision to make or hold any investment in a Fund you should consider the PDS in full. The PDS is available at www.atlastrend.com/pds or by calling AtlasTrend on 1800 589 778. The Target Market Determination is available here. A copy of AtlasTrend’s financial services guide can be found at www.atlastrend.com/fsg.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future performance. Disclosed investment returns assume reinvestment of all distributions. For the Clean Disruption Fund performance is shown net of fees. For the remaining Funds performance is shown net of fees from 7 June 2018 and prior to that performance is shown gross of any fees. Click here for more details about current and previous fee arrangements.