Gender Equality Part 2: Explaining the Gender Pay Gap

The second part of this series will look at the main causes behind the Gender Pay Gap, how this plays out at senior levels, and how Australia compares globally.

Written by Victoria Kent, Senior Investment Specialist

This information does not take into account your personal objectives, financial situation or needs. You should consider if the relevant investment is appropriate having regard to your own objectives, financial situation and needs.

In our previous article we discussed the nuance of GPG measurement (spoiler alert: measuring the gap is not a perfect science, and we end up comparing apples to grapefruits). But putting aside these limitations, the underlying reasons behind the GPG are worth exploring and addressing.

Why does the UN believe the world will not achieve equal pay until 2069 at the current rate of progress?!

According to WEGA, the Australian government’s Workplace Gender Equality Agency, these are the main causes behind the GPG:

Women and men working in different industries and different jobs, with female-dominated industries and jobs attracting lower wages.

Lack of workplace flexibility to accommodate caring and other responsibilities, especially in senior roles.

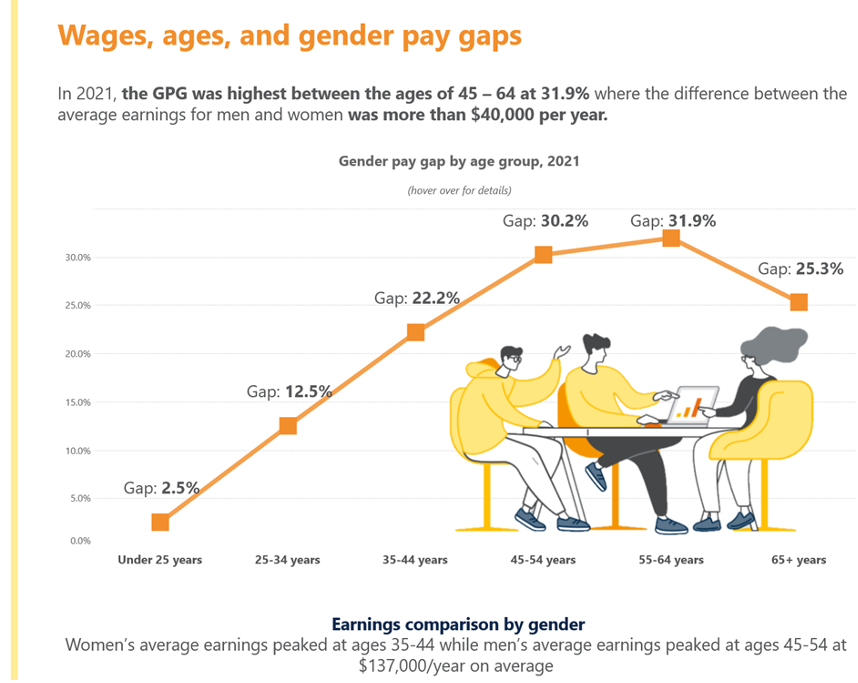

Women’s greater time out of the workforce for caring responsibilities impacting career progression and opportunities.

Men are also affected by this particular aspect of the GPG. Specifically, men are discriminated against when it comes to flexible work and parental leave.

Women's disproportionate share of unpaid caring and domestic work. According to the Melbourne Institute, women are doing far more unpaid work than men, with the gap being particularly large in heterosexual couples with dependent children. This was also backed up in the annual Household, Income and Labour Dynamics in Australia (Hilda) survey – a nationally representative study involving interviews with 17,500 people in 9,500 households, which found women were doing 21 hours more unpaid work than men a week.

And the final and most odious cause behind the GPG (in my opinion) is:

Conscious and unconscious discrimination and bias in hiring and pay decisions. “No!” I can hear you protest. “That’s not a thing!”. Unfortunately, it really is, and these biases exist right out of the gates. Findings from the Forté Foundation, a non-profit focused on women’s advancement and gender equity in business and business schools, showed the gender pay gap for MBA graduates starts right out of school, and only gets wider from there. Female business school graduates make around $11,000 less than men with the same degree, and a decade out, that gap widens to more than $60,000.

The findings demonstrate qualifications are not enough to overcome structural biases. This kind of gender discrimination gets people (rightly) hot under the collar and must be stamped out.

Women in senior roles

A recent Deloitte report found a global average of just under 20% (19.7%) of board seats are held by women, an increase of just 2.8% since 2019. If this rate of change were to continue every two years, we could expect to reach something near parity in 2045. This is why Deloitte aptly titled their research paper “Progress at a snail's pace”.

The global average is hardly representative of all nations though. On one end of the spectrum is France; which has an average board composition of over 43% women, driven largely by their gender quota (set at 40% over a decade ago). At the other end of the spectrum are countries like Qatar and Saudi Arabia, or South Korea, which report less than 5% of women on their largest boards.

You may be wondering how Australia compares to world.

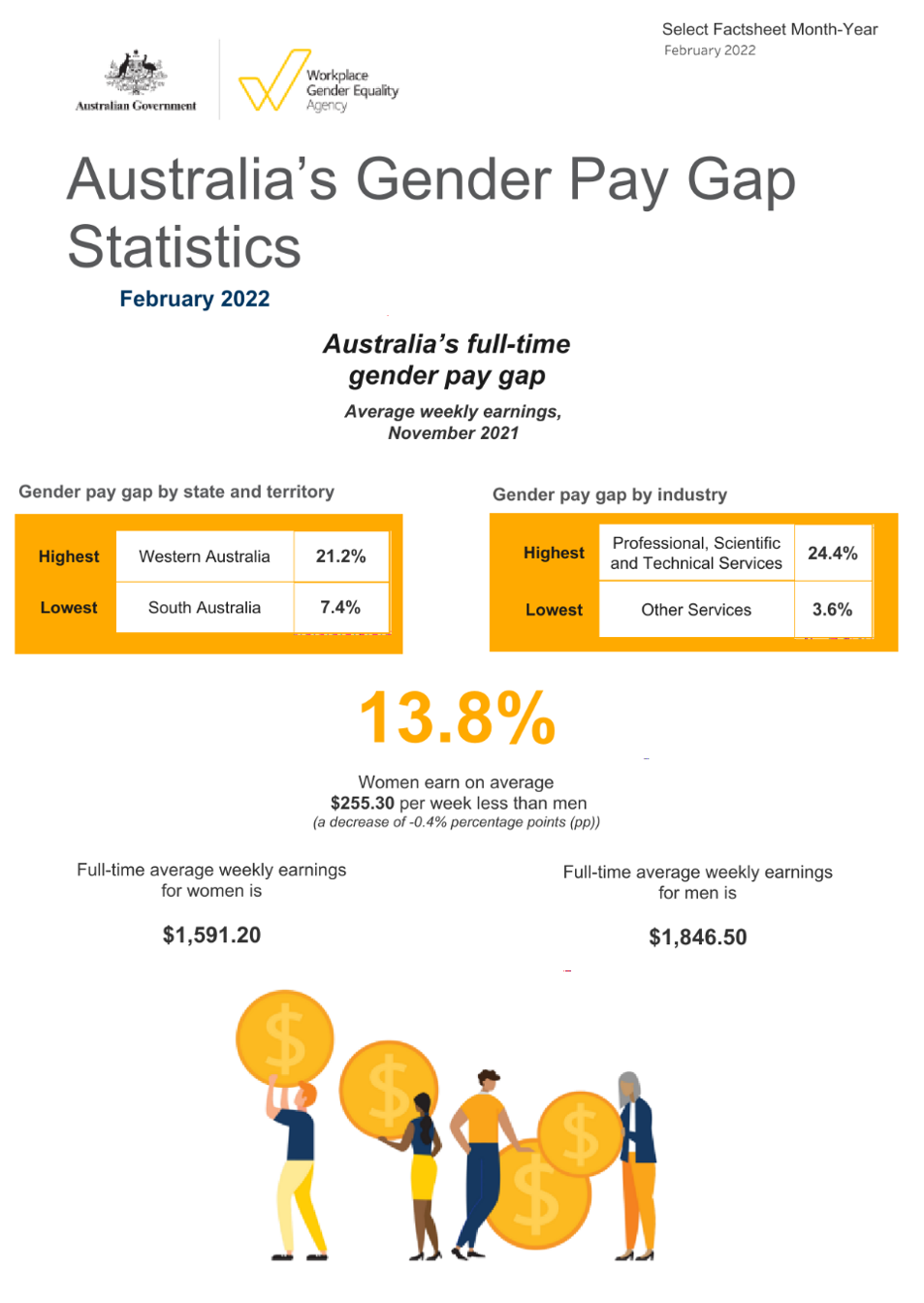

Every country in the Organisation for Economic Cooperation and Development (OECD), which includes Australia, has a GPG in favour of men. On average, women in the OECD earn 13.9% less than men (OECD Family Database, 2015).

Australia actually ranks okay compared to other nations; we lag behind Scandinavian countries but are leagues ahead of Korea (gender pay gap of 31.5%).

WGEA data shows the Australian national gender pay gap is currently 13.8% – the lowest point it has reached in 20 years.

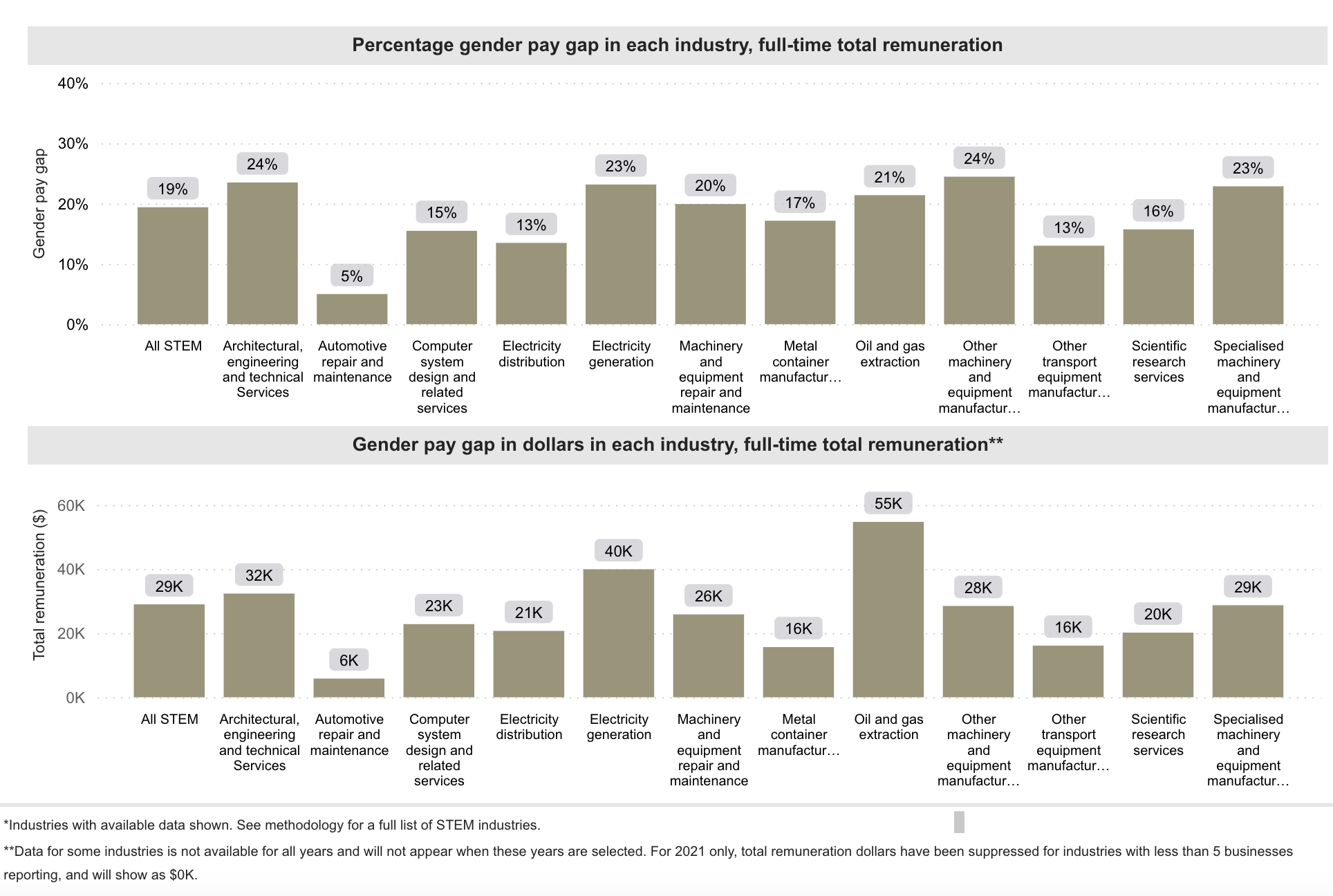

There are some interesting differences between industries.

The GPG is not equal across all industries. We recently sat down with Dr Kylie-Anne Richards, Deputy CIO and Chair of ESG at Fortlake Asset Management.

She explained the GPG in the finance sector is one of the highest at 27.5%, and women only hold 29% of senior roles. She has spent her career working in arguably the most male-dominated areas of finance – quant and trading – saying being the only female in the room was certainly an experience.

In a discussion with Elevate’s own COO, Dr Richards describes how mentoring and sponsorship, as well as resilience and a “have a go” attitude, have helped her achieve career success in a male-dominated industry.

Superannuation and the gender pay gap.

Superannuation will always be a reflection of one's working life. If the female participation rate is lower (be that through lower wages, working part-time or taking time out of the work force) than it follows that the average female superannuation balance is going to be lower.

And given the compounding nature of superannuation investments, a relatively small gap can grow much wider over time.

"Clearly, super was made without a single woman around the table because it was never set up to work for women the way it works for men" - Jane Hume, former Minister for Superannuation, Financial Services and the Digital Economy and Minister for Women's Economic Security.

Hume pointed out there is especially more to do for women over 50 years old who did not grow up with compulsory super.

It's important to know there are several schemes and tax offsets to boost your super like catch up contributions, the downsizer scheme, non-concessional contributions, spouse contributions and contribution splitting. The ATO will assess whether you are entitled to participate, and thresholds and other eligibility criteria apply.