How Much Super Should I Have By Now?

We are living longer than ever before. Are you prepared? The sooner you start paying attention to your super, the better off you will be when you retire. Your future self will thank you for it.

Written by Victoria Kent, Senior Investment Specialist

Photo by Efe Kurnaz on Unsplash

This information does not take into account your personal objectives, financial situation or needs. You should consider if the relevant investment is appropriate having regard to your own objectives, financial situation and needs.

It's depressing but true: we start ageing from the moment we are born. Our human body is just not designed for immortality. Despite this, we are living longer than ever before. Are you prepared?

Australia enjoys one of the highest life expectancies in the world, and this continues to rise. According to the latest ABS figures, a baby boy born today is expected to live to 81.2 years, and 85.3 years for girls.

But those are averages, and there is a chance you could live much longer. The oldest person ever recorded, Jeanne Calment, was born in 1875 and lived to the ripe old age of 122 years. She even outlived both her daughter and grandson.

With improvements in medicine and an increased understanding of epigenetics, humans are extending their life and prolonging their vitality, forestalling the ageing process.

While this naturally means we can work (and therefore earn) for longer, it’s prudent to consider the impact of an extended lifespan on your retirement plans.

If you plan on working until the official retirement age – 67 years for those born after 1957 – will you have enough to live how you want to? And what is 'enough'?

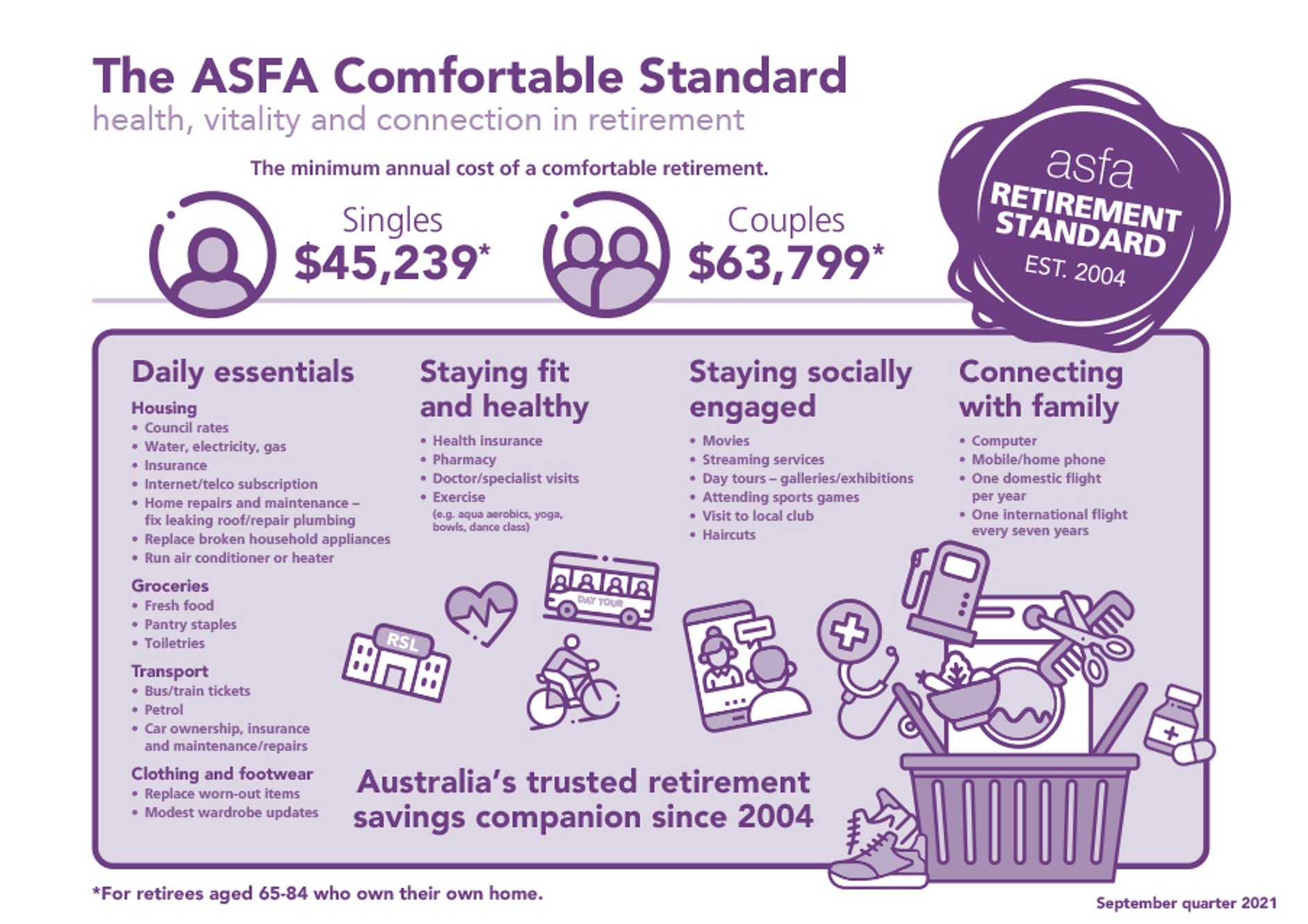

The ASFA Retirement Standard benchmarks the minimum annual cost of a comfortable or modest standard of living in retirement for singles and couples aged around 67.

This infographic sums up ASFA's comfortable retirement standard for singles and couples (who own their own home).

Source: https://www.superannuation.asn.au/resources/retirement-standard

The Comfortable Standard balance— the lump sum required for a comfortable retirement—is $545,000 in today’s dollars.

To get a bit more personal, you can use this nifty calculator to check what your super balance should be near to today to enjoy a 'comfortable' retirement as per the ASFA standards.

Say you were born in 1992, you should currently have around $54,000 in your super.

This assumes a future pre-tax wage income of around $65,000 per annum, and that you will draw down all capital and receive a part Age Pension.

If you were born in 1984 like me (*cough*), your super balance should currently look closer to $122,000.

If your current balance doesn't look like this, don't be too alarmed. Your super is just one of the three pillars of your retirement – your savings and the Age Pension being the other pillars.

No matter what your current super balance is, the sooner you start paying attention to your super, the better off you will be when you retire.

So do your future self a favour and ask yourself these questions NOW:

Where is your super? Do you have multiple accounts? If so, you may be paying multiple sets of fees. It’s 'super' easy to consolidate your accounts through your MyGov account, if you happen to have more than one fund lying around.

What super product are you invested in? What are the fees and how has it performed? Is this comparable to other funds? Perhaps you’re in a 'dud' fund like the ones recently scolded by the regulator. If you are, you should have received an email or letter about it, so dig into that in (mail) box.

How is your money being invested (asset allocation) and is it appropriate for your risk profile, age and circumstances?

Are you able to make a voluntary (after-tax) contribution?