Fund Manager Interviews Part 2: Inflation, Growth vs. Value Investing

Inflation is all the rage at the moment. We asked some funds managers about the impact of higher inflation on their portfolios.

Written by Victoria Kent, Senior Investment Specialist

This information does not take into account your personal objectives, financial situation or needs. You should consider if the relevant investment is appropriate having regard to your own objectives, financial situation and needs.

Ask any economist and they’ll tell you inflation is a good thing. It’s easier to plan and save when you know that a dollar invested now will be worth more later; or that we should not defer purchasing something now just because we expect it will be cheaper later.

But when inflation is at a level not seen for 40 years, people (naturally) feel uneasy. We have coasted for a while in an environment where interest rates have been close to zero and steadily declining, not increasing.

People are understandably concerned about how inflation will influence interest rates and therefore asset prices.

We took this opportunity to ask some active fund managers their views about the impact of higher inflation on their respective portfolios. They also shared their hot takes on the future of growth versus value stocks.

Q1. What are your views on the higher inflation levels we are seeing and what does that means for your portfolio?

Nanuk

We are not macro analysts or a macro fund, and generally try to structure our portfolio such that factors such as interest rate moves will not be a major determinant of the fund’s relative performance.

At the moment the portfolio holds stocks that are being negatively impacted by cost increases associated with the recent increase in energy and commodity price rises, but also holds stocks (for example, cybersecurity stocks) that are likely to outperform in an inflationary environment.

That said, we expect that the higher levels of inflation being experienced currently are likely to be transient, although the timeframe over which things might normalise is impossible to know and may be a relative long period. Generally, however, we see a risk that longer term rates will continue to rise.

Alphinity

Inflation pressures are increasing through the COVID 19-led supply chain disruptions, commodity index, but also through higher wages/salaries. This is being exacerbated by commodity price spikes in the wake of the Russia-Ukraine war. There are clear signs of more persistency in inflation expectations and outcomes than previously acknowledged by central banks.

We continue to see economists increasing inflation expectations across the US, Europe, UK and emerging markets. In Australia, we also expect to see ongoing pressure on inflation, although we are currently lagging other western countries to date. Extent of lockdowns has played a part in the lag.

Our focus remains on understanding the inflation implication bottom up for each company we invest in from input costs to their ability to pass price increases through. To date, increased demand and pricing power has not seen a material impact on earnings.

The impact of higher interest rates and inflation on economic growth together with geo-politics will, however, remain the key macro debate for equity markets.

Bailie Gifford

We’ve done a considerable amount of work on this theme going back several years ago, but we also focus on the operational performance of the assets, the individual companies. We look at the extent to which businesses are able to cope with a more inflationary environment. The good news for ourselves is that the vast bulk of the businesses that we are invested in for clients are ones which are asset-light in nature. They’re very scalable. They typically have large margin profiles and they’re businesses that typically will have good pricing power.

While we can choose to fret about the impact on asset values, and we understand that higher interest rates theoretically lead to lower prices or lower valuations on equities. Actually, the primary thing we need to be focused on, again, is the operational performance of individual assets.

So, we need to continue to focus on the bottom-up aspects of looking at businesses and thinking about which companies can just burst their way through expectations

Q2. What is your view on the future of growth stocks versus value stocks?

Nanuk

Our portfolio holds both growth and value stocks. At a fund level we seek to achieve portfolio characteristics and behaviour that is relatively style neutral. That said, we have generally found it difficult to identify attractively-valued growth stocks over the past two years, and that remains the case today.

Bailie Gifford

We would call ourselves growth investors because what we’re trying to do at Baillie Gifford is to identify businesses with the ability to grow their underlying profits and cash flows very meaningfully over long periods of time. What we’re trying to do is identify these businesses; the wealth creators of the future. That’s an underpinning to what we’re doing, philosophically.

I’ve felt that the divide people like to put down between growth and value is a little bit unhelpful. It’s a bit artificial and, actually, increasingly. I’m of the mind that it’s quite a dangerous thing, or it’s quite a limiting thing. So, to explain that a little bit, what we’re trying to do is to identify businesses where there is growth, but it’s got to be growth in value.

So, there’s no point in a business growing without the underlying margin structures or the returns and the capital being there to support higher valuations into the future. And what I think happens an awful lot of time, is that people like to pigeonhole you into one section, of either this growth area or this value area, and that can be very limiting. It can be very limiting in terms of stopping your flexibility as an investor.

So, there are different types of growth companies and some of them will be very high growth in nature, some will be more stalwart, like compounding businesses, and I like to have the ability to go to both of those areas and to look for mispriced growth over long periods.

Alphinity

If interest rates continue to push higher with real rates, we would expect to see a reversal of the high dispersion in the market between highly rated stocks vs lower rated stocks.

Levels of economic growth will also play a big part. Typically, value requires an improving and broadening out of economic growth for consistent performance (typically accompanied by steepening yield curve and higher rates). If economic and earnings growth rolls over and rate rises stall, growth stocks may well re-assert themselves.

Geopolitical uncertainty could, however, continue to see bond yields whipsaw, that in turn result in ongoing volatility in equity markets.

In the near term at least, higher inflation, stronger economic growth and rising rates seem to support cyclicals and value over growth, but the outlook is far from certain.

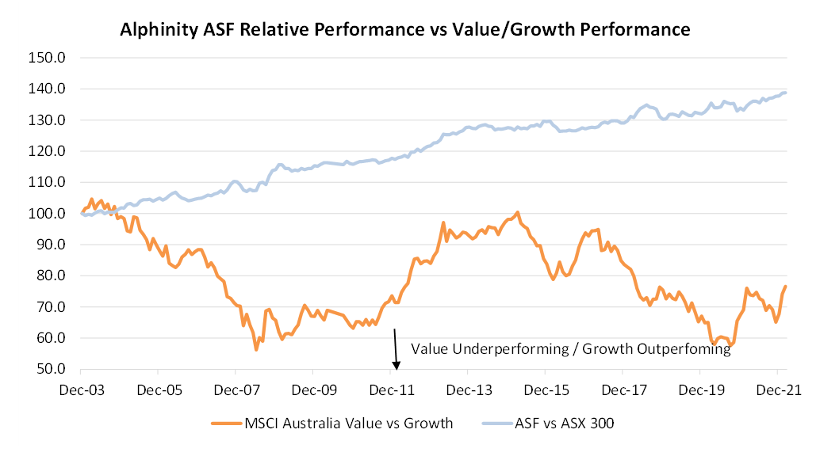

Given that we are style agnostic, we focus on companies with earnings leadership, regardless of value or growth. As per the below chart, our funds perform well through all cycles.

A well-diversified portfolio remains key in this environment, as such we continue to focus on individual stock earnings revision stories as the best risk-adjusted way of finding alpha in this market.

Source: U.S. Bureau of Labor Statistics, 18/02/22