Fund Manager Interviews Part 1: Russia-Ukraine War & Financial Markets

The geopolitical tide is changing and the global economy is changing with it. We asked our funds managers how the Ukraine-Russia conflict affects portfolios and the broader implications on commodity and energy prices.

Written by Victoria Kent, Senior Investment Specialist

This information does not take into account your personal objectives, financial situation or needs. You should consider if the relevant investment is appropriate having regard to your own objectives, financial situation and needs.

The impact of the Ukrainian crisis is far-reaching and no one can afford to bury their head in the sand. You could be financially exposed to the conflict even if you’re not directly invested in Russian or Ukrainian companies.

Sanctions, investor caution, rising commodity and fuel prices all contribute to changing the investment landscape and the value of your investments.

As investors, one of the immediate questions we had when Russia invaded the Ukraine was: are we exposed to Russian companies and or Russian state-owned enterprises?. We were relieved to discover the nominal direct exposure from an emerging markets ETF had now been removed thanks to an MSCI re-classification.

“MSCI received feedback from a large number of global market participants, including asset owners, asset managers, broker dealers, and exchanges with an overwhelming majority confirming that the Russian equity market is currently uninvestable and that Russian securities should be removed from the MSCI Emerging Markets Indexes.”

We decided to post the same question to a few prominent investment managers. Here’s what they had to say.

Q1. How does the conflict between Russia and Ukraine affect your portfolio?

Nanuk

We can confirm the Nanuk New World Fund (NNWF) has no direct exposure to Russian or Eastern European equities.

The NNWF has only very minor indirect exposures to companies with operations in or revenue exposure to Russia and Ukraine. The most significantly exposed holding is multinational paper and packaging company Mondi.

The UK-listed company has operations in Russia that account for the production related to 12% of the company’s revenue and primarily serve the local market, as well as a paper bag plant in Ukraine where production has been suspended.

The position is only 0.4% of the Fund. Aside from Mondi, the Fund’s indirect exposure is limited to a small number of multi-national businesses such as Siemens and Air Liquide, for which Russia represents less than 2% of revenue. Siemens has already suspended its operations in Russia.

Alphinity

We do not invest in any listed Russian/Ukrainian companies or companies that derive a substantial portion of their revenues from these countries.

Some of our investments have some small exposures. For example, ASX-listed company Aristocrat Leisure Limited (ALL.asx) has a team of 1000 employees working in Ukraine. The company has taken comprehensive measures to ensure the safety of their staff, including a voluntary relocation effort, funds, shelter emergency supplies and direct aid.

Bailie Gifford

It is hopefully reassuring to hear that your Global Stewardship portfolio has no Russian, Ukrainian or Belarussian listed companies in it, and indeed exposure to all three countries is very low (less than 1%).

Q2. What risks does the conflict pose to supply chain pressures? Particularly energy and commodity prices.

Nanuk

We do not believe the portfolio as a whole is significantly positively or negatively exposed to commodity price shocks. The portfolio holds a combination of stocks that are more and less impacted by commodity price rises. All else being equal, we don’t believe higher commodity prices will lead to significant fund out or underperformance.

With a longer-term viewpoint, recent events and the spike in energy prices is likely to drive greater policy support and higher levels of investment in sustainable technologies in coming years – although the impact of this will not be immediate.

Alphinity

The Russian invasion of Ukraine on February 24 kicked off historic policy actions and moves across global markets. The Ukraine crisis may slow global growth and raise inflation risks via links to Russia energy supply disruption and other commodity price volatility caused by the war. We are already witnessing consensus adjustments.

With Russia accounting for a material portion of global oil and natural gas production, we have seen the oil price surge over the $130 per barrel (bbl) mark for the first time since 2008 and gas prices have spiked to all-time highs.

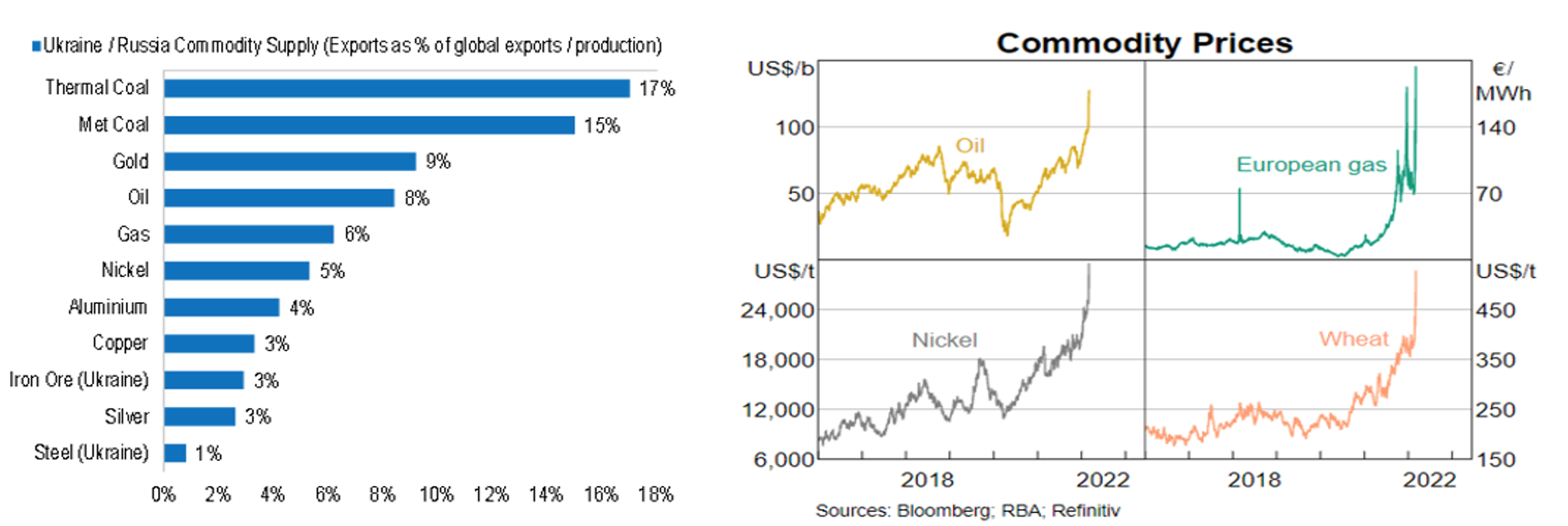

Ukraine and Russia also account for a large percentage of global supply of thermal coal, met coal, nickel and wheat (25% of global exports) – which have all spiked since the start of the invasion (see chart below). Given the expectation of an extended period of elevated geopolitical tensions, we could see commodity prices stay higher for longer.

Continued supply chain disruptions could also continue to see elevated supply chain costs persisting. While many multinationals were already investing in geographically diversifying their supply chains in the wake of US-China trade tensions, recent events may accelerate this trend.

Sanctions, and Russia’s response to them, included fresh non-tariff barriers and capital controls, which will all lead to higher input costs (and pressure on company earnings).

Source: U.S. Bureau of Labor Statistics, 18/02/22

Bailie Gifford

No direct listed investment in Russia or Ukraine does not mean the portfolio is entirely insulated from the economic impact of recent events.

The market reactions so far seem to be largely sentiment driven. The invasion has prompted many investors “fly to safety”, i.e. move assets to their perceived safe havens – trading tech for gold bullion, for example. This is bad for our portfolios are there are few perceived ‘safe-havens’ in the funds.

With supplies of fossil fuels looking like they will be constrained for the foreseeable future, energy was one of the few sectors to deliver a positive return in the month. As sustainable growth investors, we have no exposure to fossil fuels and so this hurt performance in relative terms.

Q3. What risk mitigations do you have to minimise the impact?

Nanuk

We have continued to slightly reduce exposure to stocks that are negatively exposed to higher commodity prices and inflation.

We would anticipate the dislocation in market pricing being experienced today will yield interesting opportunities and, to the extent we can find them, these will result in changes as we replace portfolio holdings with new positions offering better prospective returns.

Alphinity

Australia has relatively high exposure to in-demand commodities in everything from energy and metals to a range of agricultural products, which has already manifested itself in earnings, as well as better relative equity market performance than the rest of the world this year.

The restrictions on the Sustainable Share Fund limit the ability to be overweight energy stocks, therefore is not well positioned to benefit from ongoing commodity price strength.

We are also underweight highly-valued growth stocks (such as tech) and bond proxies, which will continue to suffer as bond yields continue to move higher.

Bailie Gifford

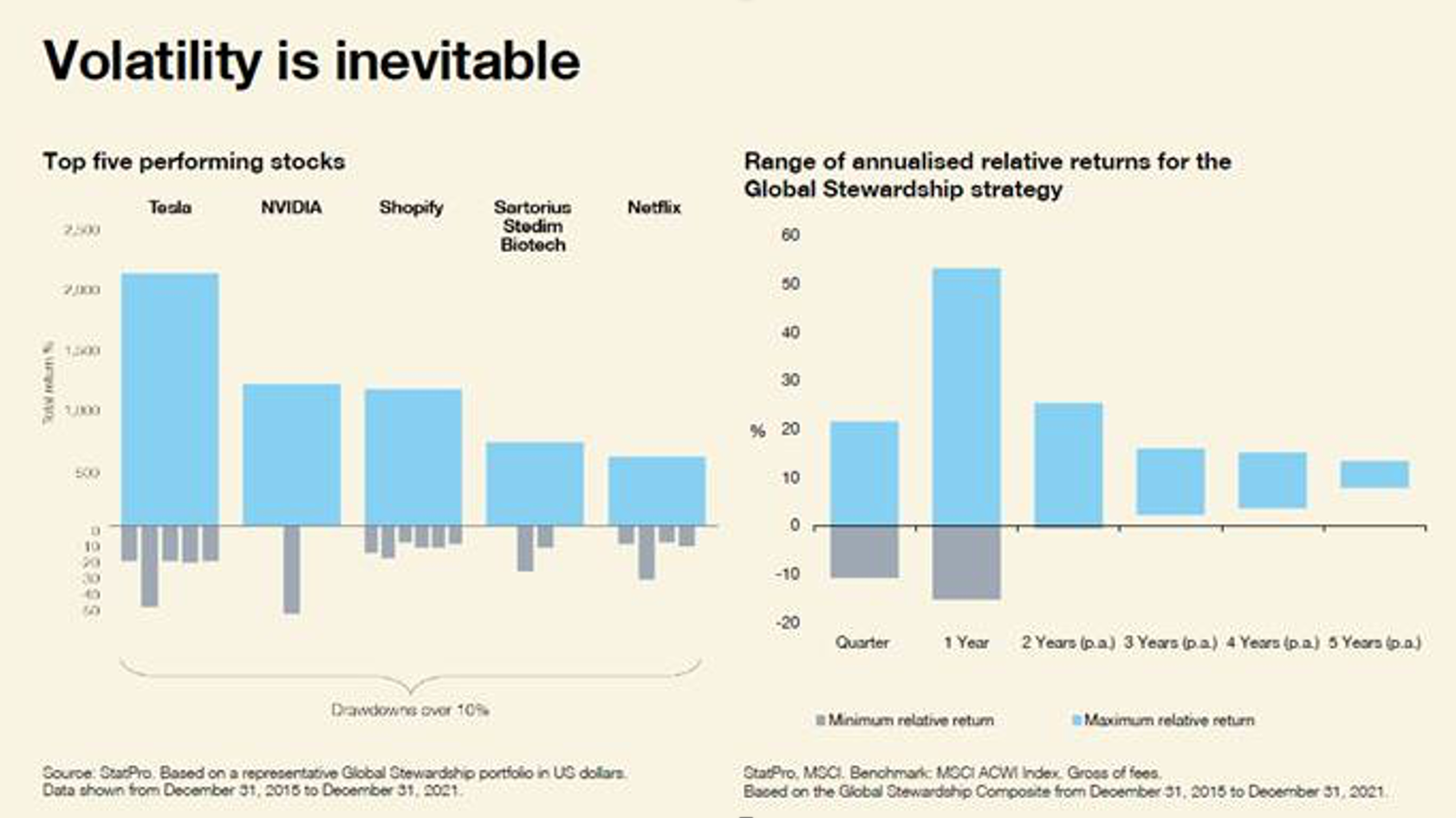

Volatility in the portfolio is inevitable, and we have seen significant drawdowns over the years in our best-performing stocks, and the long term nature of the fund reinforces the need for investors to remain patient.

A focus on the fundamentals of the portfolio is critical and there are a number of companies with a dislocation between fundamentals and share price performance. Baillie Gifford is looking to exploit this dislocation and create value for investors in the long run.