Solving The Net Zero Equation

Anyone who is anyone is claiming net zero these days. But what do these claims actually mean? And how do carbon offsets fit into the picture?

Written by Victoria Kent, Senior Investment Specialist

Photo by Efe Kurnaz on Unsplash

This information does not take into account your personal objectives, financial situation or needs. You should consider if the relevant investment is appropriate having regard to your own objectives, financial situation and needs.

You might think ScoMo, Xi Jinping and Khalifa bin Zayed Al Nahyan wouldn’t have a whole lot in common. So it may come as a surprise that each leader has set net-zero carbon emissions targets for the countries they lead (Australia, China and the UAE respectively).

Are these targets completely different? Absolutely. Are these targets unrealistic? Probably. Will these targets limit global warming to 1.5 degrees? Most would say “hell no”. But surely having a target is better than not having one, right?

According to McKinsey, as of December 2021, more than 70 countries – accounting for more than 80 percent of global CO₂ emissions and about 90 percent of global GDP – have put net-zero commitments in place as part of the United Nations’ Race to Zero campaign. More than 5,000 companies have also committed.

You can get more info on which countries and companies have committed here.

But net-zero targets are not standardised – they take so many different shapes and forms.

Targets differ in terms of the emissions sources included, the depth and speed at which emissions are reduced, and the timeframe. It wasn’t until recently that the Science Based Targets initiative (SBTi) set clearly-defined net-zero targets in line with climate science for the private sector.

The Corporate Net-Zero Standard was developed to assist companies with the transition to net-zero in a way that is consistent with societal, climate and sustainability goals and within the biophysical limits of the planet.

What makes a good net-zero target?

According to Bloomberg NEF’s Kyle Harrison, the most important inclusion in a net-zero goal is scope 3 emissions targets.

“It’s the hardest nut to crack, your indirect value chain emissions, from products downstream to suppliers upstream”.

Another good measure of a net-zero target is if it contains interim goals.

“It’s all well and good to claim net zero by 2050, but without an interim goal, you are not communicating how you are going to get there, so sceptically could just buy a bunch of offsets.”

Now is a good time to mention offsets; a carbon credit that can be bought or sold. No matter how aggressive you are at reducing your emissions, there will always be some emissions you cannot reduce. These emissions will need to be offset. Companies will need some sort of credit or verified offset.

A carbon offset is generated by an activity that either prevents the release of, reduces, or removes greenhouse gas (GHG) emissions from the atmosphere. Emission reduction projects around the world generate carbon offsets from activities such as renewable energy, biogas and reforestation.

The carbon offset market – the wild west

As decarbonisation pledges have surged, so has the offset market. Supply and demand reached a record high in 2021 and is set to grow 50-fold by 2050.

The carbon offset market is finally having its renaissance moment. Despite being around for a long time, a record 284 million carbon offsets were issued and verified, and a further 161.2 million offsets retired in 2021.

That said, removal offsets are lacking.

Currently, the carbon offset market is a bit like the wild west. Every carbon offset is unique, depending on when, where and how it was created. The price of the offset varies, and so does its quality.

There is no one way of buying an offset or verifying its quality – most trading is done through bi-lateral contracts between individual buyers or sellers.

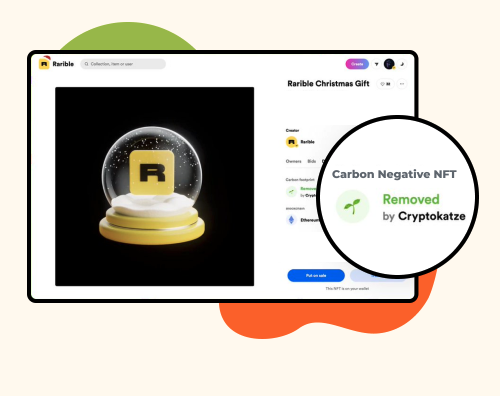

Image source: https://nori.com/token

This is changing, and there is demand for a more standardised offset market, be that through integrity initiatives, standardised contract initiatives, or even cryptocurrency (like The NORI Token).

Ideally, you need a homogenous carbon offset product, given that it is essentially a commodity that can be bought or sold.

But companies, and countries, should be doing everything in their power to first reduce their own emissions, and only then should they be using a mechanism like a carbon offset.

Solving the net-zero equation cannot be divorced from pursuing economic development and inclusive growth.

Clearly, achieving net-zero will mean a fundamental transformation of the world economy and life as we know it.